Trending Assets

Top investors this month

Trending Assets

Top investors this month

The Real Housing Crisis is not what you think

I very much agreed with Heresy Financial's take on the Housing Market, and only disagreed with his conclusion.

It's a great watch:

Essentially - he takes to task the Federal Reserve's claim that their purchasing $120 billion of debt per month ($80 billion in treasuries and $40 billion in mortgage back securities) - actually makes housing MORE affordable.

Agree -this is the biggest joke ever. Lower rates do mean people can borrow more and so their monthly payment is lower - but this generally then just manifests in higher prices when people bid up the price to buy as much house as their monthly payment will allow.

This now puts everyone in the big bind - as with prices at all-time highs, and with buyers believing this is the worst time to buy and sellers believing its the best time to sell (according to recent surveys) - we are seeing the consequence of what feels like the top of another real estate bubble.

Add to that the fact that commodity prices have been skyrocketing (though lumber finally took a nosedive) - and new housing construction is lagging the nascent demand - so housing is in a big shortage, prices have been jacked up and people are getting pissed going to open houses, competing with 20 bidders to bid 20% over ask and losing to all cash buyers.

Never mind the smart money - professional real estate investors hoovering up homes and renting out the supply at higher and higher rents.

The author argues we are well on our way to serfdom (a Frederick Hayek reference).

Here's where I disagree with the author of that video. He actually recommends that because the "smart" money is buying real estate and trying to turn our nation into renters, that everyone should just hold their nose and also buy a house at this peak of the market, or even invest in real estate through services like Fundrise.

I absolutely disagree.

You don't think real estate is in the process of going through a massive revaluation? With prices skyrocketing, have you noticed the nation's fertility rate dropping - people just saying fuck it, I won't get married, have a family, buy a house, spend a million bucks for college and child care. Our country has failed its people - and so the rational choice is NOT to have children - and I applaud every person who makes the seemingly insane choice to raise children. It's an act of the greatest faith in humanity and the greatest hope for the future.

Other factors too are at play - with cities becoming bankrupted by mismanagement and high taxes and underfunded pensions - and with COVID exposing the new remote-mode of work - it's likely that cities with high taxes and costs of living will see flight to lower density and lower cost cities. How is that for value destruction and deflation? Do you think a 700 thousand dollar studio in New York City will continue to look so great, when people move to other cities for 300k 4 bedroom houses (and no income tax to boot?)

Or what about the choice of children (or even grown adults) moving back home to live with their parents - also another rational response to the insanity that is this housing market.

Plus the author hasn't opined on homelessness - which we are seeing as a terrible and deadly consequence of this housing policy. I believe that homelessness will continue to rise -and at some point it will become a political and moral issue that cannot be ignored.

I think the housing market will unwind in the next two years. The Fed cannot continue to keep buying MBS, and so at some point mortgage debt can not keep being priced at super thin spreads over treasuries.

Could the housing crash also come from a downturn in employment - would job loss trigger defaults on mortgage payments?

How many derivatives and off-balance sheet obligations are tied to housing bets this time around? I'd love to think we learned from 2008 but I have no idea.

If and when housing crashes, I do believe the stock market will crash too - but I think we still have 18 months before that happens - so I am still inclined to be invested in stocks - and it's also very hard to time market corrections so you have to hope that you just aren't levered to the gills when the tide goes out.

Be careful out there.

--- follow up ----

Here's another video which I think has great data and insights on the coming housing crash: https://www.youtube.com/watch?v=qdqh1adkzFk

The author notes that this coming housing crash is a lot different than 2008 - where in 2008 everyone was getting NINJA loans with no standard (no income, no job, no credit) - and this time, the housing market is propped up by "transient demand" - which are flippers, speculators and institutional buyers building out rental portfolios.

Fundamental buyers - those who need a home to live in- are being priced out of the market AND it looks like banks have no desire to lend except to those with the highest credits.

The author shares a couple slides that show

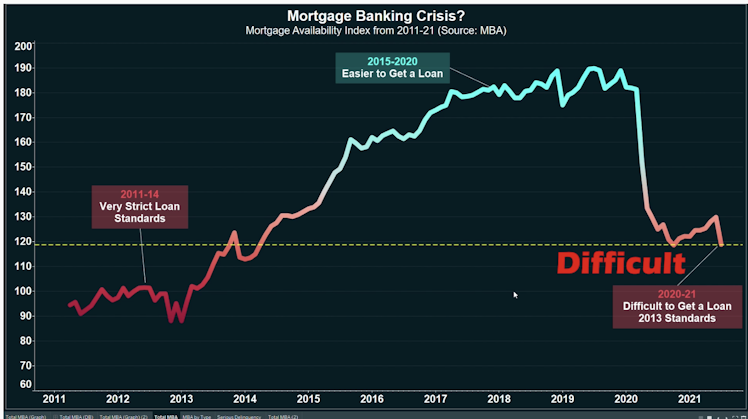

1) how difiicult it is to get a mortgage these days (mortgage availability index at 7-8 year lows (back to 2013 standards).

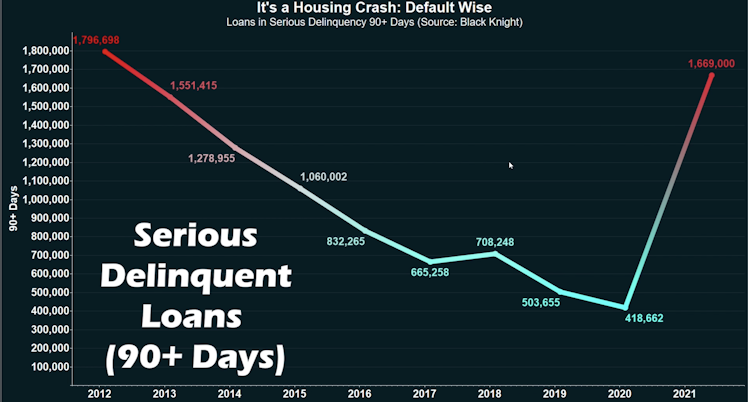

2). Banks are sitting on ton of deliquent loans, because the foreclosure moratorium (15 months ongoing now) are forcing banks to keep bad loans on their books, and borrowers in many cases have stopped paying their mortgage. This overhang is going to be interesting and tough to work off - if/when the moratorium is ended - how does that get worked off? One way is a massive flood of foreclosures and a deflationary housing bust. Another might be the government passing a law to do a mortgage reset - tack on 15 months to every existing mortgage - but then there has to be a one time charge to reflect the time value of 15 months of lost mortgage interest and servicing (and how does that work out)?

YouTube

BANKS Predicting HOUSING CRASH in 2021. Pay Attention!

Banks stopped making real estate loans in 2021. Mortgage lending standards are at strictest levels in a decade. Is a full-scale real estate banking crisis up...

Great points!! I have been dabbling to save the cash for few days as well.

Already have an account?