Trending Assets

Top investors this month

Trending Assets

Top investors this month

Tesla's BTC profit boost (Part II: Accounting flows)

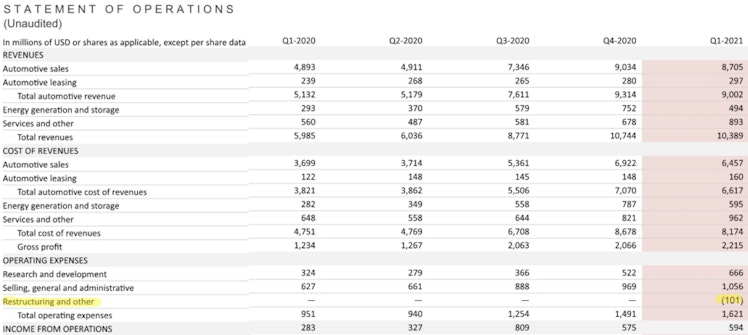

Yesterday we discussed that Tesla overstated Adj. EBITDA in Q1 2021 by $101M after including the gains from trading BTC as operating profits.

Today, let's dive into specifics and the key accounts to watch for.

In the P&L, the $101M gain from the sale of BTC was included (hidden?) in "Restructuring and other" in Adj. EBITDA. Not exactly the most descriptive account.

Only realized (sold) gains and losses from BTC are recognized in the P&L.

The unrealized (unsold) gains and losses are ignored from Tesla’s financial statements.

The reason is… well, that’s how the accounting for digital assets work! It's related to the accounting conservatism definition.

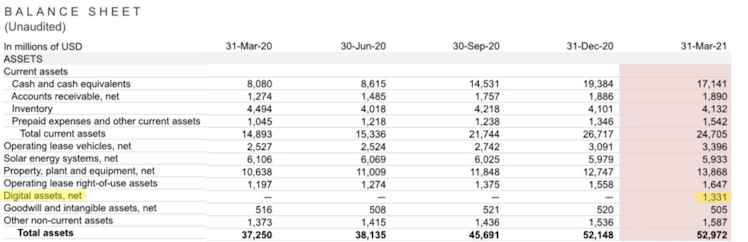

On the balance sheet, there is a new account, “Digital assets,” where the BTC investments are recognized at cost and valued at $1,331M as of the end of Q1'2021. This amount is net of the BTC sold during the quarter.

Tesla disclosed the market (fair) value of the remaining BTC investment at $2,48B, but the accounting rules forbid them from recognizing gains from unsold BTC.

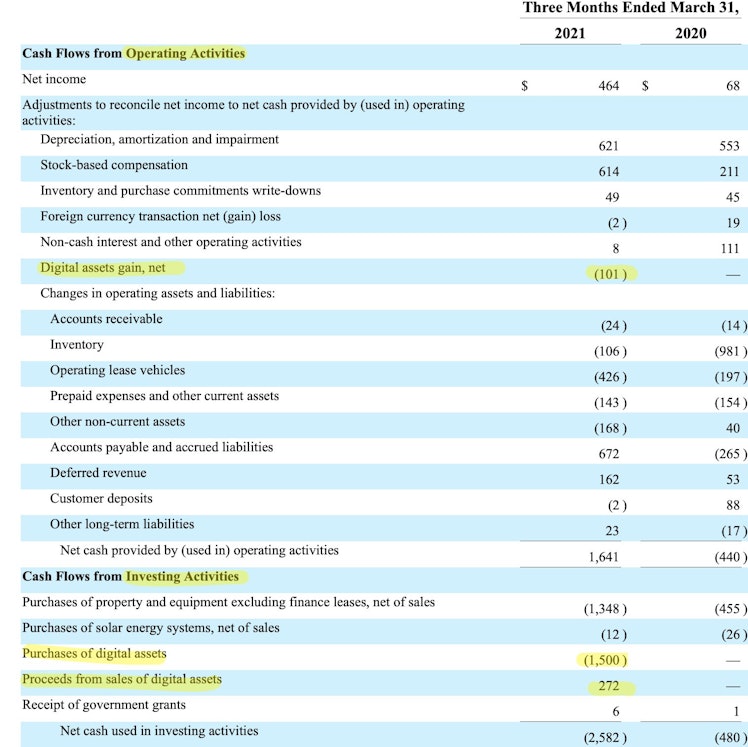

In the cash flow statement, we notice the "Digital asset gain, net" of $-101M in CFFO. This means that Tesla removes the gain from the operating section. This movement provides further evidence that the BTC gain should not be part of EBITDA.

The investing section includes the cash flows in the quarter: 1) cash outflow of

$1,5B of BTC investment and 2) cash inflow of $272M from the sale of BTC.

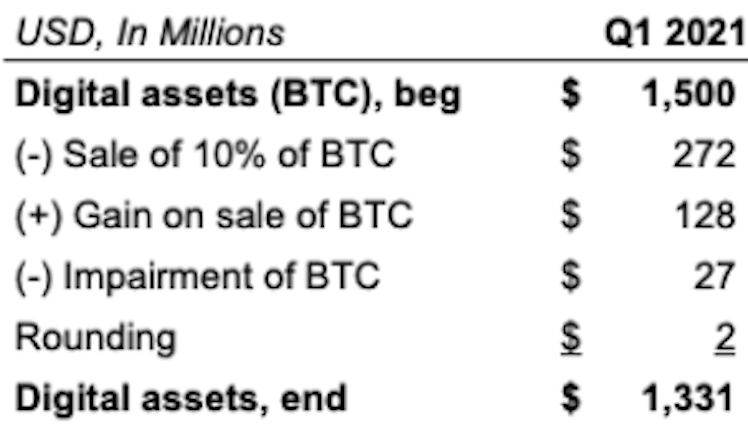

Putting all of these transactions together, we can roll forward the Digital asset account from the beginning ($1,5B) to the end of the quarter ($1,331M.)

Already have an account?