Trending Assets

Top investors this month

Trending Assets

Top investors this month

Jack Dorsey's Endgame (Afterpay + Q2 Earnings Breakdown)

Square X Afterpay

Monday was absolutely insane for Square shareholders. Out of the blue and unbeknownst to anyone, Square unveiled that it’s acquiring the “buy now pay later” company named Afterpay for $29 Billion AND preannounced stronger than expected earnings. The share price of $SQ in response rocketed up over 10% intraday and closed at $272.38 a share from $247.93 at the open. Needless to say, everyone was talking about Square on Monday, and for a good reason.

What is Afterpay?

Afterpay is an Australian fintech company that allows you to shop for your favorite brands and pay later, always interest-free. If you select to go with Afterpay at checkout your purchase will be split into 4 separate payments, payable every 2 weeks.

How does Afterpay make money?

Since Afterpay doesn’t charge interest on the payment plan you choose, it makes money from commissions from hundreds of partner merchants and of course fees incurred from customers who miss their payments. A key thing about Afterpay is it allows users to buy a product for “free” (until the specified payment dates), test out that product, and if not desirable be returned back to the store without ever having to put a dollar down. This “buy now, pay later” concept has exploded across many different platforms with even Apple and a similar payment fintech company Affirm announcing their collaboration right after the Square news. In the 2020 fiscal year, Afterpay reported $519 million in revenue which is 97% YoY from $264 million the year prior. Afterpay is currently not a profitable company since it lost close to $23 million in that period but considering the scale at which Square will be using Afterpay that won’t be a problem.

Why does Square want Afterpay?

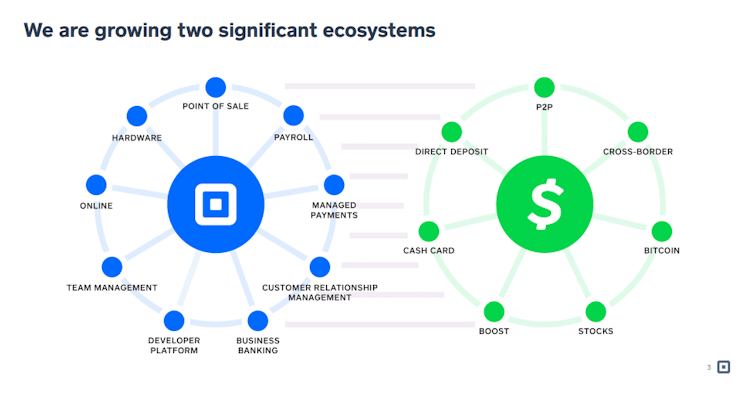

In my opinion, Afterpay fits perfectly into Square’s ecosystem that has been carefully orchestrating over the past couple of years. In a prior newsletter about Square’s takeover of Tidal, I dive into how Square, Cashapp, Tidal, (and now Afterpay) will eventually all be one well-oiled machine and completely integrated with each other. Jack Dorsey wants Square to be the one-stop shop for small businesses and eventually all different sizes of businesses. For example, A store uses Square tech hardware for receiving in-person purchases, Square then handles all background finances/loans/accounting/etc., CashApp becomes the method in which employees are paid rather than waiting weeks for their paystub, and now customers can use Afterpay in which their purchases at a business using Square (or any bank) are made instantly with no money down. Square can immediately incorporate Afterpay into its payment processing equipment as which tallies up to well over $2 million merchants (that count was as of 2019 so I’m sure that number is larger now).

So basically Jack is forming a monolithic machine in which:

1) Square is the future of banking for small businesses (now mid to even large businesses).

2) Cash App is the future of peer-to-peer payments, payroll/salary deposits, crypto, and stock purchases.

3) Tidal with the help of Jay-Z will hopefully be the one-stop-shop streaming, banking, and payment service for all types of artists. I explain that here.

4) Afterpay will be used to “buy now and pay later” at all types of businesses but immediately with all current Square merchants. Along with this, Affirm’s 16 million users will eventually be able to control installment payments directly through Cash App. Who knows the legality of this but possibly “buy now and pay later” for stocks and crypto in Cash App?

5) Twitter is the all-seeing eye media component that shapes the sands of online discourse and public perception. Also very helpful when needing free advertising of all businesses mentioned above.

6) Last but not least, Jack is dedicating an incredible amount of time to the crypto community and in particular the Bitcoin space. He has repeatedly talked about working on a Bitcoin hardware wallet (likely under Square). My guess is there will be future acquisitions of crypto hardware/platform companies coming very soon as his bullishness on decentralized finance has swelled to Everest heights.

Needless to say, Jack is building an empire and he is doing it rather fast. Call me crazy but someday could see him on the heels of Zuck’s net worth - especially if the goals of Square, Cash App, Tidal, Afterpay, and Twitter continue to thrive.

“Together, we can better connect our Cash App and Seller ecosystems to deliver even more compelling products and services for merchants and consumers, putting the power back in their hands.” - Jack Dorsey

Square Earnings

Monday morning the Afterpay revelation wasn’t the only unexpected news to come out.

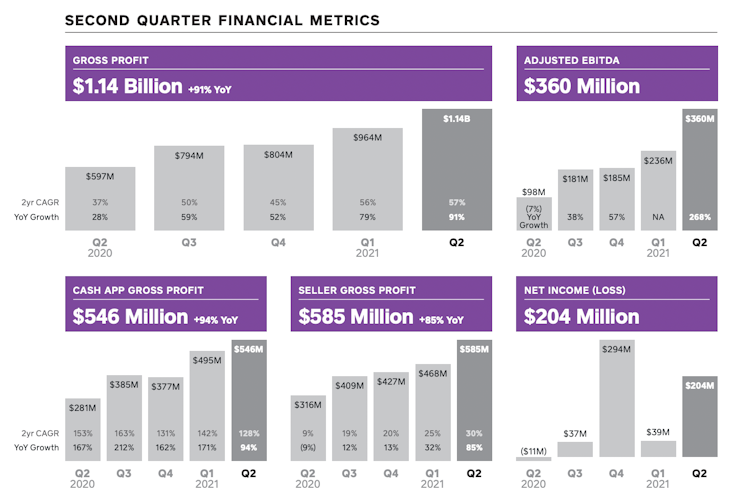

Square posted their earnings for Q2 early as seen below:

Revenue: $4.68 B vs. $5.05 B est. (143% YoY for Q2)

EPS: $0.66 vs. $0.31 est. (266.7% YoY for Q2)

Gross Profit: $1.14 B (91.2% YoY for Q2)

Net Income: $204 M (negative for 2020 Q2)

Although Square missed on this quarter’s revenues once again their growth in Cash App has investors buzzing. Here is a breakdown of that growth for the quarter.

- Cash App generated $3.33 B in revenue (177% YoY for Q2)

- Cash App generated a gross profit of $546 M (94% YoY for Q2)

- On a two-year CAGR basis, revenue and gross profit for the Cash App ecosystem grew 258% and 128%.

- Excluding Bitcoin, Cash App revenue was $606 million in the second quarter, up 87% YoY.

- Cash App generated $2.72 B of bitcoin revenue and $55 M of bitcoin gross profit during Q2, each up approximately 3x YoY

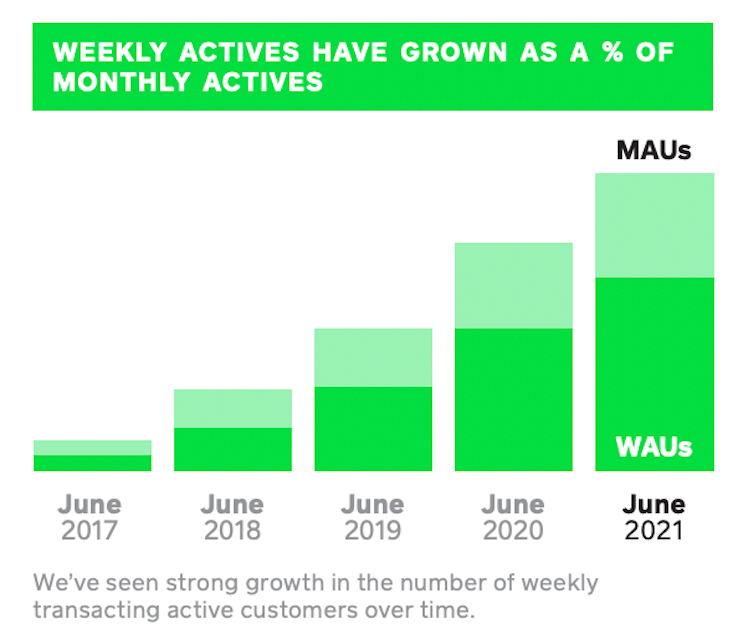

- In June Cash App reached 40 million monthly transacting, active customers

- Volume for Q2 sent through Cash App’s network increased by nearly 4x compared to two years ago

- Nearly 4.5 M customers held a stock or ETF in the Q2 alone, an increase of more than 3x from a year ago

Investors can’t get enough of the rocketship growth in Cash App numbers and this quarter was no different. We saw an acceleration in Cash App’s mission and strategic marketing events with Megan Thee Stallion, Miley Cyrus, and many others.

Naturally, most of you were scrambling to watch Square $SQ rocket up 10% in a single day on Monday. Typing in Google your brokerage account, going through the sign-in, and typing in the ticker has wasted me more time than I can even express.

Using only your mouse, you just highlight the ticker, right-click and select your destination. This will then take you straight to the ticker on your preferred brokerage. The in-browser pop-up will store recent transactions, allows you to favorite tickers, and contains a search page that enables you to quickly navigate to over 40+ supported destinations.

As most of you know, I love to share the tools that help me be a better investor like optionsprofitcalculator.com, YCharts, etc. Mark et cap is simply a no-brainer free extension and I can honestly say I was stoked when they reached out to me to sponsor this post. Do yourself a favor and save time by adding it to your browser here.

In Conclusion

I’m long (and have been) $SQ and might even add more (not advice). I believe the company is on the right path with incorporating all these different revenue streams and the icing on the cake is they are all growing at an incredible rate. As I have mentioned before, Jack is building an empire!

Lastly, if you would like to receive memos like this directly to your inbox so you don't miss them click here to subscribe to my newsletter.

Thank you all who read this far, have a great weekend!

-Gannon

rebelmarkets.substack.com

Rebel Markets | Gannon Breslin | Substack

Finance Education & Market News Worth Knowing. Click to read Rebel Markets, by Gannon Breslin, a Substack publication with thousands of subscribers.

Already have an account?