Trending Assets

Top investors this month

Trending Assets

Top investors this month

One of the easiest layups in investing history

If I were to boil the thesis down to 5 bullet points, I’d say:

- Uranium is an essential input for nuclear reactors with no substitute. Following the Fukushima disaster, there was a massive supply glut as reactors were taken offline due to safety concerns

- Now a supply crunch is looming, with a current market deficit of ~40m lbs

- Nuclear power plants usually contract uranium supplies several years out before their inventory gets run down. Due to the oversupply coming out of the previous cycle, however, they have been purchasing additional supply needs in the spot market instead of contracting years in advance.

- The power plants’ coverage rates (contracted lbs of uranium supply / lbs of uranium required) are beginning to trend below 100%, indicating utilities have less locked-in supply than they need to keep running their reactors, at a time when market supply is tightening (note utilities typically look to maintain coverage ratios well above 100% to ensure no unforeseen shortfalls)

- Global demand for uranium is increasing, with ~56 new reactors under construction an a further 99 in planning currently. Nuclear power currently generates ~10% of the world’s electricity but with the closure of coal and fossil fuel power plants due to ESG considerations, nuclear energy is increasingly being seen as the only viable way to make up up the lost energy capacity.

(For a more thorough analysis, go here)

Putting all of this together, a fundamental supply/demand imbalance for an essential commodity with price insensitive buyers and ESG tailwinds makes the bull case extremely compelling.

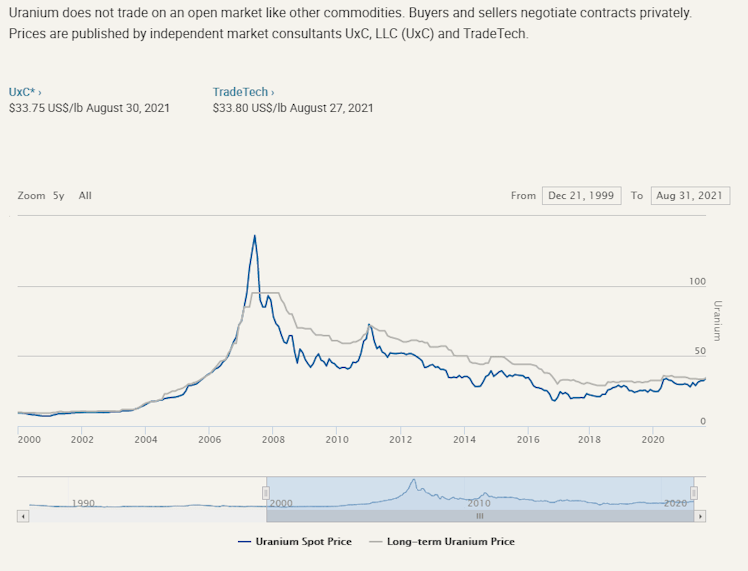

But a picture is worth a thousand words, so some historic charts probably best provide a sense of the future upside expected in the next cycle. At the peak of the previous uranium bull market in 2007 (when there was no supply deficit) the uranium spot price reached ~$136/lb after a run up from ~$15/share at the start of 2004 (~9x increase).

Today the current price is ~$42/lb with the view that the price will reach new highs in this coming cycle:

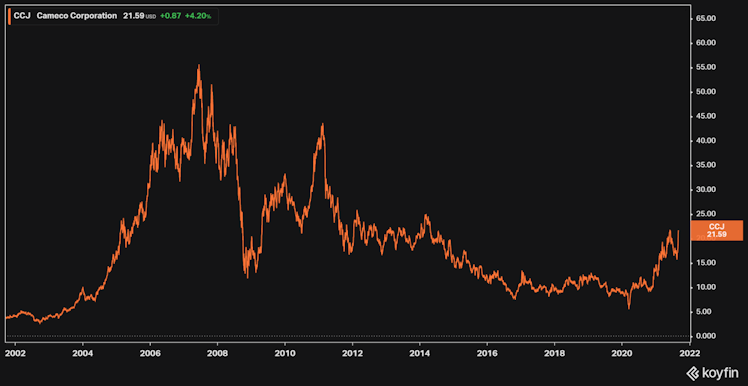

Many uranium investors focus on the miners rather than the commodity as being the way to play the new uranium bull market, as these are more levered to price increases in the underlying commodity.

The share price for Canadian-based Cameco Corporation (CCO / CCJ, the second largest uranium producer in the world) increased from USD $3/share to $55/share ( ~18x bagger) during the previous bull market from ~2004 – 2007:

While Cameco’s performance was impressive, it was not the biggest winner during the previous uranium bull market.

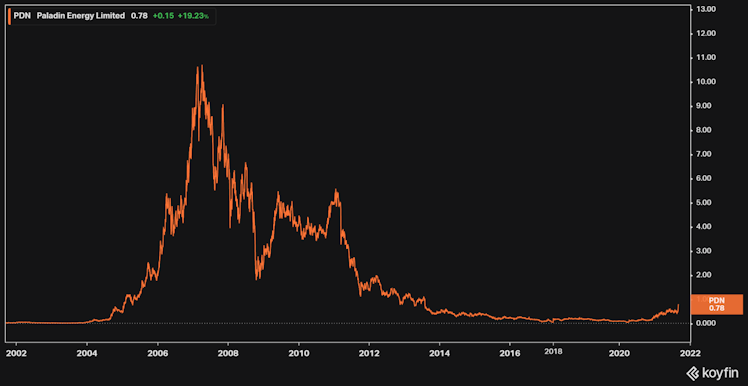

Australian miner Paladin Energy ($PALAF) went from AUD $0.01 to AUD $10.70 (~1000x! ) between late 2003 and the market peak in Q1 2007:

Similar multibagger returns for uranium stocks will be seen again if a new bull market in uranium materializes in the coming 2-3 years when utilities’ uranium supply falls to inoperable levels & they begin contracting again for new supplies.

Paladin in particular is expected to be big winner in any new bull market, as it operates one of the lowest cost uranium mines in the world, the Langer Heinrich mine in Namibia, which was a fully producing mine before being idled in the last bear market.

As such, it is a ready-to-go miner rather than a speculative prospect, and so is in a position to immediately capitalise on an uptick in uranium prices and a new contracting cycle with utilities.

Given the extent of the structural supply/demand imbalance (which again wasn’t present during the previous bull market) combined with utilities likely becoming forced purchasers of uranium at almost any price, market commentators are forecasting the uranium spot price to reach highs of up to $150/lb, thus enabling the producers to contract at price levels 3x+ the current spot price, driving a massive increase in profitability and cash flows.

With some very interesting dynamics and the sprott uranium trust acting as a catalyst, I think the uranium market has the potential to offer a really unique and asymmetric return over the next 2 years.

Cheers!

Bloomberg.com

CCJ: Cameco Corp Stock Price Quote - New York - Bloomberg

Stock analysis for Cameco Corp (CCJ:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

Already have an account?