MACRO: Six Big Reasons to Buy Small-Cap Stocks

One of the least loved areas of the market is getting an upgrade today.

Battered small-caps have not kept pace with large-caps all year. But we see that dynamic shifting.

There are six big reasons to buy small-cap stocks over the near-to-medium term.

As a reminder, last August we told you to buy small-cap stocks. Our analysis pointed to an 8% 12-month price gain, plus dividends.

Since then, small-cap equities are up about 12%. Not bad. But the S&P 500 is up roughly 25%.

Smaller stocks have historically delivered higher returns than the S&P 500. Lately, not so much.

Today, we’re going to dive into the macro picture, which signals explosive gains could be on the horizon.

If that’s not enough, as a bonus we’ll even showcase a top-rated stock beaming with Big Money support.

It’s time to go big by going small!

To kick things off, let’s rewind the tape to March. Back then we told you Federal Reserve rate cuts might be delayed but they wouldn’t be denied in 7 Charts Signal More Pain for the Bears.

Sure enough, recent dovish economic data has Fed easing back on the table. Futures markets expect the first rate cut in September.

Treasury yields are pulling back after a big year-to-date run-up.

Lower rates are great for small-cap stocks because they stimulate economic growth. Small companies are more leveraged to the health of the economy than larger firms. Small companies also carry more debt than blue chips and pay higher interest rates on those loans.

Add it all up and the first reason number to like small-cap stocks is for their love of falling interest rates.

There’s a clear negative correlation between the 10-year Treasury yield and small-cap stock performance. When one zigs, the other zags.

Falling rates mean it’s finally time to bet big on small-cap stocks. Notice how when the black line (10-year yields) falls, the S&P Small Cap 600 (blue line) surges:

Let’s keep this bullish thesis going and talk about valuations.

Small-cap stocks have rarely been cheaper relative to the S&P 500. Since 1995, they’ve averaged a 3% valuation premium because they’ve delivered slightly higher long-term returns.

Right now, at 14.9x 12-month forward earnings per share, small-cap stocks are trading at a 27% discount to the S&P 500’s forward price-earnings ratio of 20.3x.

A historically low relative valuation is reason number two to start overweighting smaller companies:

Can it get better? YES!

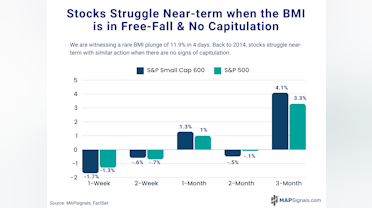

The S&P SmallCap 600 index is currently trading in its cheapest historical valuation quartile. The following chart should rattle some bears.

Since 1990, small-cap stocks have posted a 23% average 12-month gain when starting from the cheapest quartile.

A rock-bottom absolute valuation is a solid third reason to own small-cap equities:

The best tactical news we can share is that market participation has been broadening. We made mention of this back in January when we told you Macro Drivers Signal a Broadening Rally in 2024.

Technology isn’t the only game in town anymore. Cyclical sectors like energy, industrials, and financials are all up big this year.

The fourth reason small-cap stocks should be on your radar is due to our sector rankings. Since March, our favorite areas have been none other than energy, financials, and industrials, echoing our bullish small-cap tilt:

And for our readers that like playing the index theme, here’s the best part: small-cap indices like the Russell 2000 and the S&P SmallCap 600 are loaded with cyclical stocks.

The number five reason to like small equities is due to their heavier weight in these cyclical areas.

Financials and industrials combined are nearly 50% of the allocation in the S&P SmallCap 600 compared to less than 25% of the S&P 500.

Check it out:

With the economy continuing to hum, inflation falling, and Fed easing around the corner, greater cyclical exposure means it’s finally time to bet big on small-cap stocks.

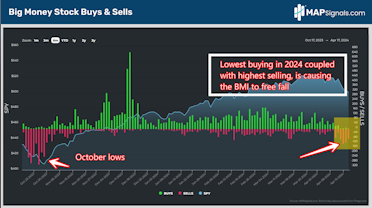

And the Big Money has been doing that in spades over the last three months.

The number six reason to buy smaller stocks is money flows favoring them recently. A staggering 83% of our 4,877 discrete equity inflows have been in companies with market caps below $50 billion:

Add it all up and the macro and money flow backdrop favors previously unloved small-caps. That’s a powerful 1-2 punch!

And to give you an idea of what the rewards of focusing on top-ranked stocks under heavy accumulation look like, check out a recurring theme in our data since last August.

Energy firm Tidewater, Inc. ($TDW) has been one of the most bought names in the past year. Each of these blue signals are the times the stock landed on our Top 20 list.

Rarely do stocks have a money flow picture this strong:

And I should mention our consistent bet on Super Micro Computer, Inc. ($SMCI) beginning in the summer of 2022 – in the teeth of the bear market.

Bet on small-caps, but also focus on the best of breed stocks loved by institutions.

Goldilocks growth and falling inflation mean the Fed will begin easing later this year. Treasury yields are pulling back after a big run-up. Falling rates mean it’s finally time to bet big on small stocks.

And don’t forget that since 1990, small-cap stocks have posted a 23% average 12-month gain when starting from the cheapest quartile.

Throw in Big Money buying and a bigger allocation to the resurgent energy, financials, and industrials sectors, and you’ve got a recipe for success.

Add it all up and small stocks offer a great risk/reward profile.

Use a map to spot the outliers!

If you want to identify specific small-cap stocks ramping with Big Money support, get started with a MAPsignals PRO subscription. It’ll get you access to our portal that updates every morning, showcasing the stocks getting bought and their scores.

It’s time to go big by betting small with MAPsignals!

Invest well,

-Alec Young

portal.mapsignals.com

MAPsignals Portal